USDA Home Loans

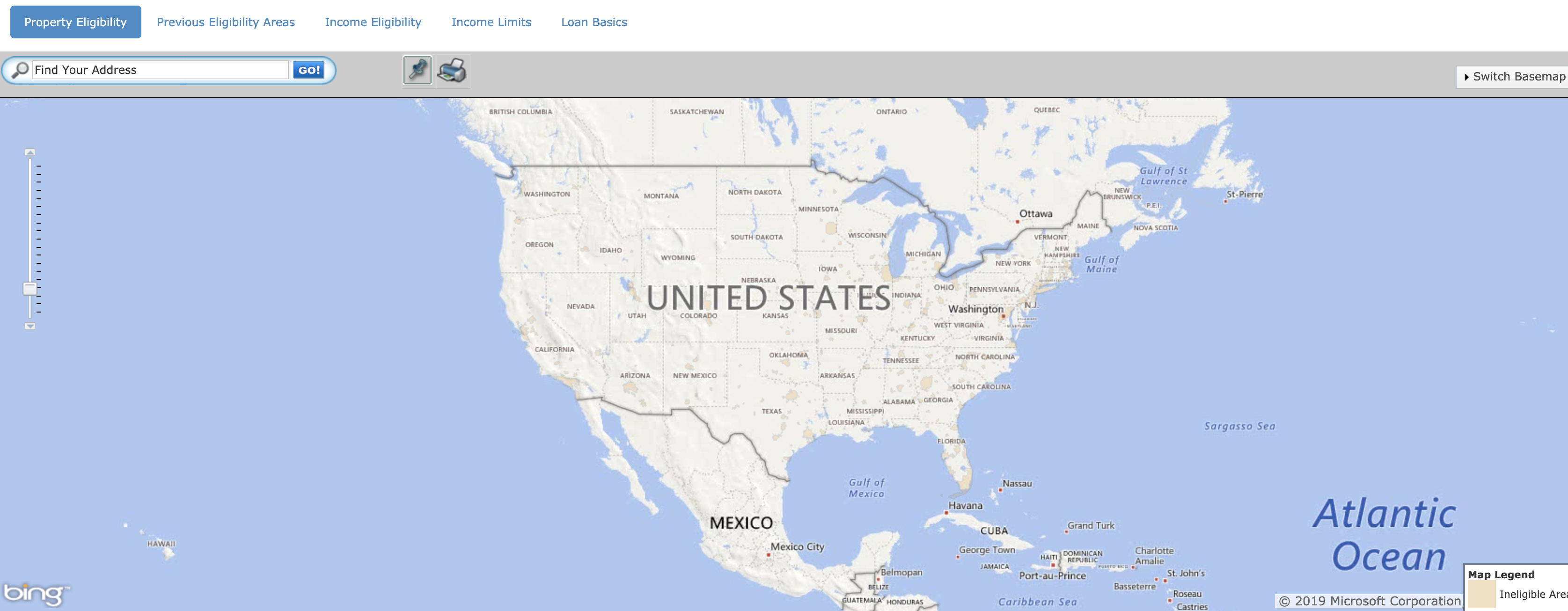

The home loan program offered by the USDA (the United States Department of Agriculture) is growing rapidly in popularity. While often mistakenly taken for a program exclusive to farmers and people living in rural communities, the USDA program actually includes many growing towns and cities across the country. The program is appealing thanks to its no down payment option and the first step to checking your eligibility is to simply type your zip code in on the USDA website and see if you're buying an eligible community.

USDA Home Loans Are No Money Down Loans

The main perk of the USDA program is that you won't have to put anything down. This is one of the few no money down programs offered, with most others being exclusive to those employed by certain fields, like people in the military. That makes the USDA home loan program extremely popular. Getting a USDA mortgage is also surprisingly simple, you just have to meet a few basic requirements.

Who's Eligible?

There are a few steps to checking if you are eligible for USDA loans. The first would be to book an appointment with a loan officer to ensure you get all of your questions answered. There are two types you may qualify for: the Single Family Housing Direct or the Single Family Housing Guaranteed. Which program you qualify for will be based on your income, with a higher household income taking you into the guaranteed program.

In order to qualify for the USDA program, you must make no more than a certain amount in a year. However, this program is not exclusive to low-income borrowers. The county income limits are based on the median income in your community. That means those with very low, low, and moderate income all qualify. For example, in Boulder County (Colorado), the current annual income limit is $108,550 for a 1-4 person household. Limits increase for larger households.

When it comes to credit score, the USDA does not actually define a minimum credit score needed to get a loan. However, your credit score will still impact your interest rate. If you go through the guaranteed program (which will mean finding a third-party lender to fund your loan), you will need to meet their credit score requirements. Generally, that means having a score of 640 or above.

Finally, the USDA program allows borrowers to have up to a 46% debt-to-income ratio, which includes your potential mortgage payment. This is higher than many other programs, and it's great for those with a car payment and other monthly expenses that could otherwise disqualify them from a mortgage program. This means someone earning $4,000 per month could have up to $1,840 in expenses (including their mortgage payment). So, if you have a $300 car payment and $200 credit card payment, you could still qualify for a mortgage with up to a $1,340 monthly payment. In this scenario, a good interest rate and a standard 30-year term mean you could buy a house for up to $280,000 with no money down.

What's the Difference Between Direct and Guaranteed?

Many people get confused when they begin hearing the terms "direct" and "guaranteed" loans. The main difference is who ultimately fronts the money for you to purchase a home.

Low and very low income borrowers qualify for the direct program. As the name implies, this means the USDA will fund your loan directly. They do this because it is otherwise very difficult for the average low income borrower to find a lender willing to fund a mortgage for them. Moderate income borrowers, on the other hand, qualify for the guaranteed program. This allows you to shop around and find a lender who offers mortgages through the USDA program. That lender will be the one giving you the money, but the USDA is promising (i.e., "guaranteeing") to repay the lender should you default on your mortgage.

Qualifying for the USDA's guarantee basically gives the lender peace of mind because it means they are taking on virtually no risk by lending to you. This is helpful for borrowers with below average credit scores and/or higher debt whom lenders otherwise would be weary about lending to. Keep in mind that the lender still ultimately determines your interest rate, which is still based on your credit score and perceived risk. With the direct program.

What if I don't qualify?

There are two common reasons that might make you ineligible for the program, those being that you're shopping in an ineligible area or you make more than the overall county income limit for your household. In either situation, you must rule out the USDA program and look for another mortgage program that fits your needs. Unless you plan to shop in an eligible area or lower your income to meet the guidelines, the USDA will not make exceptions.

Know the Details

Once you know that you qualify based on the area you are buying in, the amount of money you make, and so on, you might also want to think about the other details governing this program. For instance, there are only certain types of properties you can purchase with the USDA home loan program. Single family housing is the most popular, but you could also explore the USDA's multi-family housing loan options.

If you end up purchasing through the USDA Home Loan program, you'll be excited to know that they do not enforce overall lending limits, which makes them a favorable option over the FHA program and even conventional loans. However, you won't be able to just open as much as you please. The amount you can spend on your home will be calculated using your overall income and expenses.

Additionally, every one must go through some basic home buyer education coursework before the loan can be finalized, which is a pretty standard procedure for any mortgage program today. With those simple steps, you can be well on your way to home ownership.

Sign up to get information about USDA Home Loans, money saving opportunities. and tips and tricks to save money when buying a home or completing a refinance.

Get A Home Loan Quote Noew

Have Us Figure Out What Loan Is Best For You Now